Profitable

Quick to access and simple to use, wherever you are. One document is all that's needed

Quick to access and simple to use, wherever you are. One document is all that's needed

A direct lender that values responsibility and innovation. We ensure your data's security and help in hard situations

A simple, rapid solution from the comfort of your home. Instant money transfers and flexible loan periods

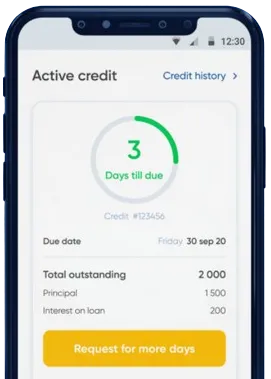

Initiate your application on our app by completing the required form.

Expect a decision in as little as 15 minutes.

Have the money transferred to you, usually within one minute.

Initiate your application on our app by completing the required form.

Download loan app

Small loans are becoming increasingly popular in South Africa due to their accessibility and convenience. With the rise of online lenders, individuals can now apply for small loans from the comfort of their own homes, without the need to visit a physical bank branch.

One of the main benefits of small loans online in South Africa is the quick approval process. Online lenders often provide instant decisions on loan applications, allowing individuals to access funds in a matter of hours or days, rather than weeks.

For individuals in need of urgent financial assistance, small loans online offer a fast and efficient solution.

Online small loans in South Africa also offer flexible repayment options, allowing borrowers to choose repayment terms that suit their financial situation. Some online lenders provide the option to customize loan terms, including the loan amount and repayment period, to meet the specific needs of the borrower.

Additionally, online small loans often come with transparent fees and interest rates, making it easier for borrowers to understand the total cost of the loan and plan their repayments accordingly.

Unlike traditional bank loans that often require collateral, small loans online in South Africa typically do not require any form of security. This means that individuals can apply for a small loan without risking their assets, making online loans a more accessible option for those who do not have valuable assets to offer as security.

According to recent data, over 80% of online small loans in South Africa are unsecured.

Applying for a small loan online in South Africa is a simple and convenient process. Most online lenders have user-friendly websites or mobile apps that allow individuals to complete the entire application process online, from submitting their personal information to signing the loan agreement.

With 24/7 access to online loan applications, individuals can apply for a small loan at any time, making it easier to access funds when they need them most.

Small loans online in South Africa offer numerous benefits, including quick approval, flexible repayment options, no collateral requirement, and a convenient application process. For individuals in need of immediate financial assistance, online small loans provide a practical and accessible solution.

Small loans online are short-term loans that are typically provided by online lenders. These loans are usually for small amounts and are used for immediate financial needs.

Most online lenders in South Africa require borrowers to be 18 years or older, have a South African ID, a regular source of income, and a bank account.

The loan amounts for small loans online in South Africa typically range from R500 to R8000, depending on the lender and the borrower's creditworthiness.

Repayment periods for small loans online in South Africa can vary, but they usually range from 1 month to 6 months.

Many online lenders in South Africa offer quick approval and funding, with funds often deposited into the borrower's bank account within 24 hours of approval.

Interest rates for small loans online can vary depending on the lender and the borrower's credit profile. In South Africa, interest rates for small loans online are typically higher than traditional bank loans due to the shorter loan terms and lower loan amounts.